|

|

|

|

|

Cash Bids

Market Data

News

Ag Commentary

Weather

Name

Resources

|

Can AI Help AMD Stock Soar 59% in the Next 12 Months?/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) has been trailing the broader market over the past year, with its stock down approximately 21.4%, while the S&P 500 Index ($SPX) has risen by about 11.4%. However, AMD’s underperformance may not last long as it expands its artificial intelligence (AI) portfolio, which is expected to drive its data center AI revenue and support its share price. AMD Is Catching Up in the AI BoomWhile the broader AI market has already boosted the stock prices of some tech giants, AMD has been slower to see its stock price reflect its growing presence in the space. Nonetheless, the company’s Instinct AI accelerators are experiencing rising demand as enterprises and cloud providers expand their AI infrastructure. AMD’s broader AI portfolio, spanning GPUs, processors, software, and complete rack systems, is laying the groundwork for solid growth in its top line and share price. At its recent “Advancing AI” event, AMD unveiled new additions to its Instinct GPU lineup, the MI350X and MI355X. These GPUs are designed to meet the demanding requirements of modern AI workloads and are available in both air-cooled and liquid-cooled configurations. The high computing power of new GPUs will translate into faster AI deployment and lower costs for enterprise customers, potentially strengthening AMD’s position in the AI infrastructure space.

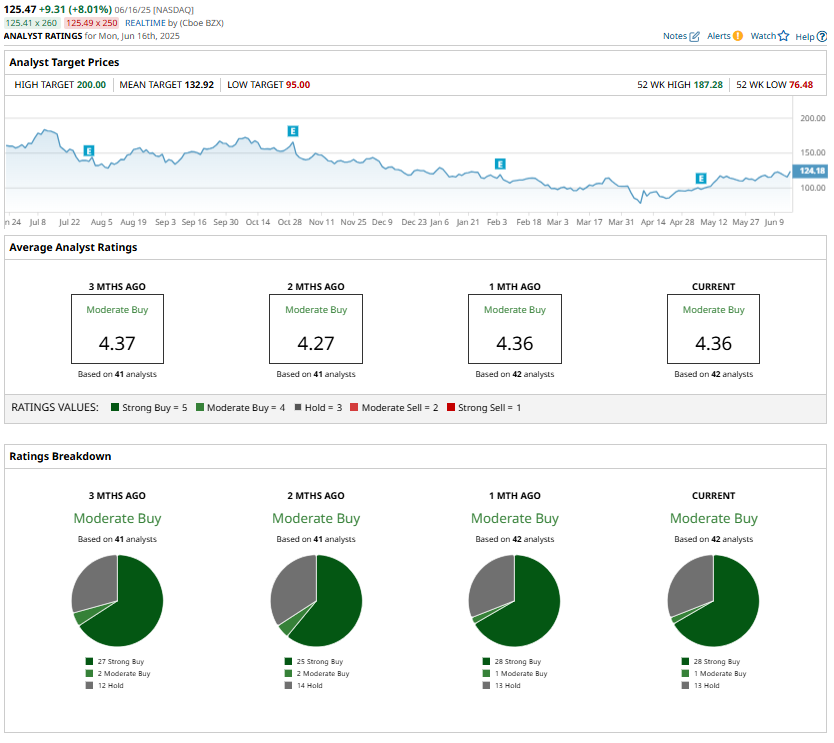

The company also gave a sneak peek into its upcoming “Helios” AI rack, which will be built around its next-gen MI400 Series GPUs. Alongside hardware advancements, AMD continues to strengthen its AI software foundation with ROCm 7, the latest version of its open-source stack designed to meet the increasing demands of generative AI and high-performance computing. These new products highlight AMD’s continued execution of its AI strategy, positioning it well to deliver solid growth. Thanks to its expanding product portfolio and strong pipeline, Wall Street sees upside potential in AMD stock. Moreover, the Street-high price target of $200 indicates 59% upside potential from current levels. AMD to Deliver Higher AI RevenueAMD will benefit from the solid demand for its Instinct AI accelerators in the data center business. In the first quarter, AMD’s data center AI business posted significant double-digit growth as the company ramped shipments of its MI325X GPUs. These chips are now powering more than 35 platforms across leading service providers. Hyperscalers are expanding their use of AMD’s Instinct accelerators for critical generative AI workloads. AMD’s partner ecosystem is also growing, positioning it well to deliver solid growth in the coming quarters. Along with cloud and enterprise sectors, AMD will benefit from sovereign AI opportunities. The recent acquisition of ZT Systems (and subsequent decision to sell everything but its core engineering team) adds another layer of strength to AMD’s offering. With ZT’s system design expertise, AMD can now deliver rack-level AI solutions based entirely on its CPUs, GPUs, and networking technologies. This shortens deployment timelines for hyperscalers and accelerates time-to-market for OEMs and ODMs. Analysts’ Recommendation for AMD StockAnalysts have a “Moderate Buy” consensus on AMD stock amid broader macroeconomic uncertainty. AMD stock is currently trading at a forward price-earnings ratio of 36.8x, which may seem high at first glance. However, with analysts forecasting 22.9% EPS growth in 2025 and a staggering 51.2% in 2026, the valuation appears more than reasonable for a company likely to benefit from robust demand for AI.

The Bottom LineAMD’s strategic push into AI infrastructure is starting to yield results, setting the stage for significant growth ahead. With robust demand for its Instinct accelerators, a deepening software and hardware portfolio, and innovations such as the Helios rack and ROCm 7, AMD is likely to gain traction in the high-growth AI infrastructure market. AMD’s expanding ecosystem, bolstered by the acquisition of ZT Systems’ engineering talent, further enhances its ability to deliver integrated, scalable AI solutions. While the stock has lagged recently, the momentum behind its AI growth story may catalyze a significant turnaround. With AMD maintaining its execution pace and capitalizing on rising demand from enterprises and hyperscalers, a 59% surge to the $200 price target appears within reach. On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|